Atlantic Edge Insights

July 2025

What the One Big Beautiful Bill

Means for Your Financial Plan

New tax strategies for children, estates, Roth conversions, and high-income families

On July 4th, the "One Big Beautiful Bill" (OBBB) was signed into law, making major changes to the tax code. It permanently extends key parts of the 2017 Tax Cuts and Jobs Act (TCJA), while adding new tax tools and revising deductions.

Here are the most relevant changes for our clients in Florida and across the country, with a focus on proactive strategies and financial planning opportunities:

1. New: “Trump Accounts” for Children

What is it? A new federal savings program for minors, created to encourage early financial security and reduce long-term wealth inequality.

-

Babies born between 2025 and 2028 will automatically receive a $1,000 federal contribution if an account is opened.

-

Contributions grow tax-deferred and automatically convert to a traditional IRA when the child turns 18.

-

Qualified withdrawals can be made for college, job training, or a first-time home purchase.

-

Employers are eligible to elect up to a $2,500 contribution to the account.

Client Takeaway: The Trump Account is ideal for capturing the $1,000 federal contribution. Beyond that, families should evaluate their goals before committing more dollars.

We recommend the following order of operations:

-

Start with a Trump Account to receive the one-time $1,000 federal contribution (for eligible newborns). It’s a free benefit and a unique jumpstart opportunity.

-

Use a 529 Plan to fund larger education goals. These accounts allow for tax-free growth and withdrawals for qualified educational expenses. They also recently permit up to $35,000 of unused funds to be rolled into a Roth IRA (subject to strict conditions: the 529 must be open for 15+ years, rollovers are capped at annual Roth contribution limits, and prior contributions within five years cannot be converted).

-

If the child has earned income, a Roth IRA is usually the next-best option. Notably, it offers tax-free growth, qualified education withdrawals, and a first-time homebuyer withdrawal.

Why it matters: Each of these accounts has different strengths, limitations, and use cases. Understanding how they interact can help families save smarter and preserve flexibility.

Potential Opportunity: Clients expecting children in 2025–2028 should consider opening a Trump Account for this new child promptly to receive the federal bonus. From there, the decision between Roth and 529 depends on the child’s age, income, and expected educational path. We can help you determine the right mix.

2. Expanded Uses for 529 Plans

What changed? 529 plans are now more flexible.

-

Starting in 2026, up to $20,000 per child can be used annually for K–12 private or religious school tuition (previously $10,000).

-

The law also expands eligible uses to include post-secondary licenses, credentials, and certifications.

Why it matters? 529s now offer more than just college funding. For families considering private school or professional training, these plans offer increased utility.

Potential Opportunity: Clients funding 529s should revisit savings goals and contribution strategies. Those planning to utilize private education should be aware of these enhanced features.

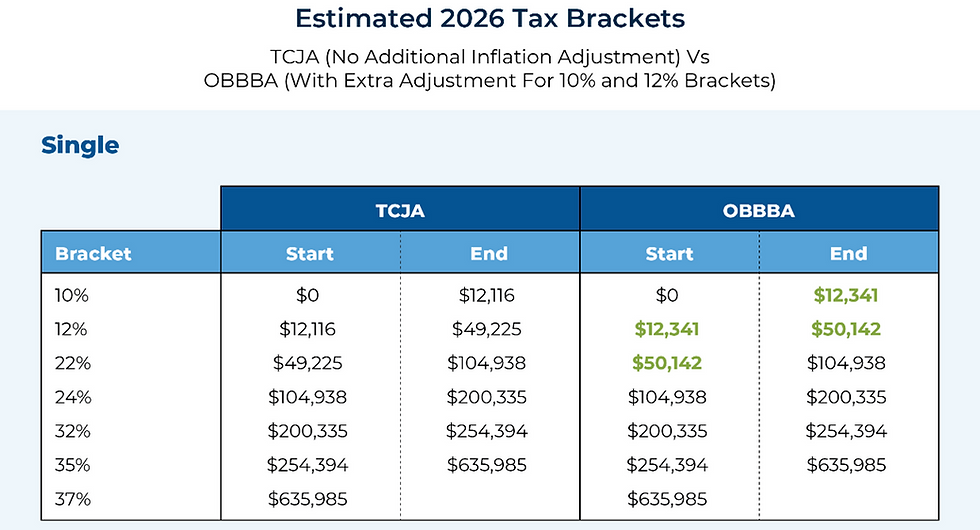

3. 2026 Federal Tax Brackets (Adjusted for Inflation)

Why it matters: The TCJA individual tax brackets were made permanent, with an annual inflation adjustment. Knowing where your income falls can shape your investment strategy.

Potential Opportunity: Consider income-smoothing strategies, bracket awareness, and reviewing tax thresholds annually. In some cases, it may make sense to intentionally realize income.

Source: Kitces.com

4. Roth Conversions in the New Tax Environment

What changed? With the tax brackets now locked in, Roth conversions remain a strategic lever - especially in lower-income years.

Why it matters: Locking in today’s tax rates may be more attractive than facing unknown brackets in the future, especially for those with lower incomes or large traditional IRAs.

Potential Opportunity: A carefully executed Roth conversion can save taxes, reduce future RMDs and create tax-free wealth. Work with your advisor to model outcomes based on your goals and tax situation.

5. Estate Tax Exemption Raised to $15 Million

What changed? The lifetime gift and estate tax exemption increased to $15M per person ($30M for couples), with no expiration date and inflation indexing.

Why it matters: The permanent exemption allows for more deliberate, long-term estate planning.

Potential Opportunity: The higher exemption reduces the urgency for strategies like irrevocable trusts that are designed to shrink a taxable estate. Instead, this opens the door to longer-term, flexible planning. Focus may shift toward:

-

Annual gifting

-

Gifting appreciated stock during life

-

Retaining control for income tax and step-up in basis advantages

6. SALT Deduction Cap Temporarily Increased

What changed? The state and local tax (SALT) deduction cap increased from $10,000 to $40,000 through 2029, phasing out at $500,000 MAGI. Reverts back in 2030.

Why it matters (mostly outside Florida): While this helps clients in high-tax states, it has less of an effect on Florida residents where state income tax is zero.

Potential Opportunity: For clients with homes in other states, high state and local taxes or complex trust structures - timing income and deductions could produce benefits.

Other Tax Filing Facts: New Deductions and Expiring Perks

In addition to the headline planning changes, the new tax law includes several below-the-line deductions and temporary breaks that may impact future returns:

-

Standard Deduction Increased

Beginning in 2025, the standard deduction increases to $15,750 (single) and $31,500 (married filing jointly), permanently indexed to inflation.

-

Extra Deduction for Seniors (2025–2028)

Seniors age 65+ receive a temporary additional deduction of $6,000 ($12,000 if both spouses qualify), phasing out for joint incomes above $150,000–$250,000 MAGI.

-

Child Tax Credit Raised

The child tax credit increases from $2,000 to $2,200 per child in 2025, with inflation indexing starting in 2026. Income phaseouts remain at $200K (single) / $400K (joint).

-

Auto Loan Interest Deduction (2025–2028)

Interest on new loans for U.S.-assembled personal-use vehicles may be deductible, up to $10,000 per year, subject to income limits ($100K single / $200K joint).

-

Mortgage Insurance Deductible Again (Starting 2026)

Homeowners paying mortgage insurance (e.g., FHA loans) can once again deduct premiums, permanently reinstated.

-

Social Security Still Taxable

Despite expanded deductions for seniors, Social Security benefits remain subject to existing tax thresholds.

-

Clean Energy Credits Repealed Early

Credits for electric vehicles, solar panels, and home efficiency improvements expire between 2025–2026. Clients considering upgrades should act soon.

In Summary:

The One Big Beautiful Bill Act brings long-awaited clarity, and a few new tools, to the tax planning landscape. Some strategies may need to be re-evaluated, while others become more compelling. Our team at Atlantic Edge is ready to help you assess how these changes apply to your specific situation and explore strategies that fit your goals.

Let us know if you’d like to schedule time to talk through your financial plan and strategies.

Opinions expressed in this commentary may change as conditions warrant and are for informational purposes only. Information contained herein is not intended to be personal investment advice for any specific person for any particular purpose. We utilize information sources that we believe to be reliable but cannot guarantee the accuracy of those sources. Past performance is no guarantee of future performance; investing involves risk and may result in loss of capital. No graph, chart, formula or other device can, in and of itself, be used to determine which securities to buy or sell, or when to buy or sell such securities, or can assist persons in making those decisions. Consider seeking advice from a professional before implementing any investing strategy.

We are happy to provide a second opinion analysis of your portfolio