Market Commentary

January 2026

A Bull Market Until Proven Otherwise

Stocks

Global equities extended gains in the fourth quarter, finishing the year on strong footing. International developed stocks led the way, increasing by 4.54%. The S&P 500 gained 2.35%, as resilient earnings growth and growing confidence in Federal Reserve rate cuts supported earnings expectations and valuations.

-

International equities led the way. International equities were led by European stocks that gained as earnings expectations for 2026 were upgraded. Most emerging market stocks performed even better, though economic uncertainty in China weighed on these returns.

-

U.S. earnings remained resilient. The S&P 500 gained 2.35% to finish the year as companies continued to deliver solid results in Q4, reinforcing confidence that profits can continue to grow even if economic activity moderates.

-

Leadership broadened modestly. While large-cap technology stocks remained influential, value outperformed growth, supporting a portfolio with diversified equity exposure.

Overall, equity markets ended the year reflecting optimism that inflation will begin cooling in 2026 without a meaningful slowdown in economic growth.

Bonds

Bond markets were steadier in the fourth quarter as investors became more confident that policy rates had peaked.

-

Longer Yields moved modestly higher. Despite rate cuts by the Federal Reserve, rates moved higher in the 4th quarter.

-

Credit conditions stayed supportive. Investment-grade and high-yield spreads remained tight, signaling confidence in corporate balance sheets and a low risk of recession.

For the year, the aggregate bond market increased by 7.30%, through a combination of higher interest income and decreasing rates. Despite falling rates, the 10 year treasury still earns more than 4% in interest, far higher than prevailing rates in the 2010s.

The Bull Rumbles On

Entering 2026, equity markets remain firmly in focus, particularly given valuation levels that sit well above long-term averages. Both U.S. and international equities are trading above the 90th percentile of historical valuation ranges. That fact alone often raises concerns about whether markets have moved “too far, too fast,” causing some to predict an end to the bull market that began in October 2022

History suggests caution with that conclusion:

-

High valuations are rarely a reliable timing tool. Markets often remain expensive for extended periods when supported by strong earnings, favorable economic conditions, and productivity gains.

-

Markets often driven by momentum over short periods. Investors who reduce exposure solely because valuations appear elevated frequently miss continued upside, as markets tend to advance until a more fundamental catalyst intervenes.

This lesson was reinforced over the past year. Price/Earnings ratio (P/E) for the S&P 500, a common measure of whether stocks are expensive, decreased, albeit marginally, in 2025. Instead, strong earnings drove stock prices higher. In simple terms, profits did the work. While valuations stayed high, rising corporate earnings justified those prices and pushed markets higher.

Don't Fight the Fed

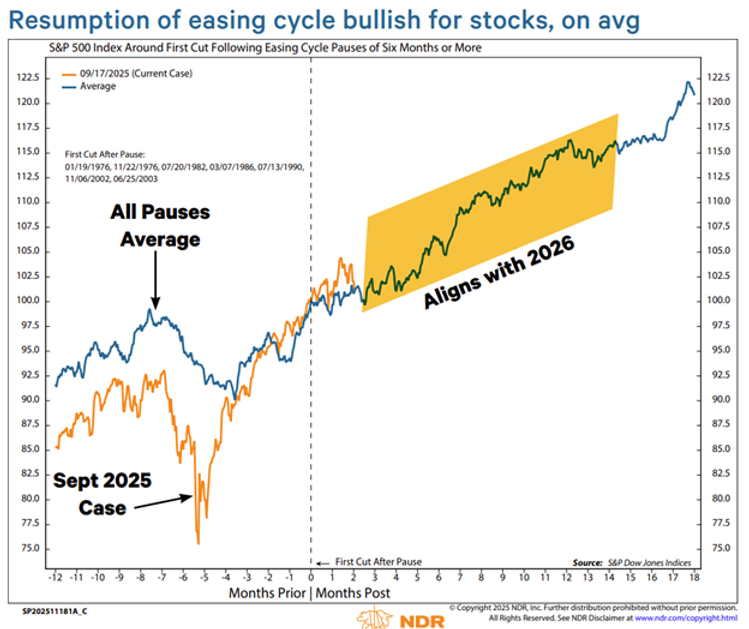

Following a series of cuts that culminated in late 2024, the Federal Reserve paused its easing cycle as the economy digested economic changes, before resuming last October with consecutive cuts during the final three meetings of 2025. The Federal Reserve is expected to make two more rate cuts in 2026.

-

Stocks exhibit high returns when Fed begins to lowers rates. Throughout history, market participants have been rewarded for remaining invested when the Fed begins lowering the rate at which it loans to banks.

-

Stocks also react positively following a pause. This dynamic holds not only when the Fed begins an easing cycle, but also when it resumes following a pause. Early returns since September track the historical pattern and provide a harbinger of strong returns in 2026.

Earnings Growth Remains the Market's Anchor

Earnings growth continues to be the most important pillar supporting equity markets:

-

Robust growth expected in 2026 and 2027. S&P 500 earnings have been trending higher since 2023 and are expected to remain strong through 2026 and 2027.

-

Strong earnings are not only a U.S. phenomenon. Earnings growth outside the U.S. is improving and expected to catch up with US growth, supporting a geographically diverse portfolio.

AI Productivity Gains: Broad, Gradual, and Powerful

While much of the attention around AI has focused on technology companies, the more durable impact is beginning to unfold across the broader economy.

-

Consumer companies are using AI to improve demand forecasting and inventory management. Manufacturers are optimizing production lines, reducing downtime, and improving quality control. Industrial firms are enhancing logistics, maintenance schedules, and energy efficiency.

-

Unlike prior technology cycles, the biggest productivity beneficiaries are often outside traditional technology sectors, making this a more broadly supportive earnings tailwind.

Where Valuations Create Risk

Elevated valuations do, however, raise the bar. When expectations are high, markets become less forgiving. If earnings fall short of optimistic forecasts or if productivity gains take longer to materialize, valuation compression is a real risk. Instead of exiting the market, valuation risk can be can be mitigated by avoiding some of the most expensive stocks while focusing on firms with lower valuations and more consistent earnings growth.

That said, it’s important to distinguish between risk and inevitability. Valuations alone do not end bull markets, earnings disappointments do. As long as corporate profits continue to grow, markets can sustain higher valuation levels for longer than many expect.

Bottom Line

Markets are expensive, but they are not detached from fundamentals. Earnings growth remains solid, economic tailwinds are strengthening, and productivity gains, particularly from AI, are increasingly evident across a wide range of industries.

For long-term investors, the greater risk is not remaining invested in a high-valuation environment, but instead stepping aside while earnings continue to support higher prices. Until profits meaningfully deteriorate, the evidence points to staying disciplined and focused on fundamentals.

In short, this remains a bull market until proven otherwise.

Portfolio Positioning

Stocks

Entering 2026, economic growth remains strong and the Federal Reserve is expected to continue cutting rates, conditions that have historically supported strong stock performance. However, many investors are concerned that the S&P 500 remains expensive and concentrated. While significantly pulling back exposure to stocks in a bull market seems unwise, we continue to position away from the most expensive stocks and focus instead on more fairly valued stocks with strong earnings growth that can provide downside protection if earnings growth among the most expensive stocks slow.

For the first half of the 2020s, international stocks lagged US stocks. During this period, we remained invested in international stocks. That relationship flipped in 2025, as expected earnings growth in Europe and Japan moved higher. Continued exposure to these stocks provides further diversification benefits that will enhance returns if earnings growth internationally continues to catch up to the US.

Bonds

In the 4th quarter the 10-year treasury rate increased even though the Fed cut rates. While this may seem counter-intuitive, last quarter we wrote:

Often, the 10-year treasury rate will continue to fall during an easing cycle that culminates in a recession, but when the Fed cuts rates in a non-recession environment, the 10-year usually bottoms before the first cut. Remember, when rates fall, bond prices rise. The longer the maturity, the greater the increase in price.

We continue to favor shorter term bonds, especially when we can construct a high quality portfolio yielding 6% interest.

High yield spreads, the extra interest earned over less risky treasury bonds, remains at its lowest point in almost 20 years. This means that investors are being paid less to hold riskier bonds. Because of this dynamic, we reduced exposure to high yield bonds by in mid-2025. Since then, spreads have compressed further. While we continue to hold these bonds as economic growth remains strong, we remain ready to reduce, or even eliminate, this exposure if spreads compress further or the future pace of economic growth is in doubt.

Atlantic Edge Insights

Matthew Cochran, CFA

Robert Filosa, CFA

Ethan Caldarelli, CFA

Opinions expressed in this commentary may change as conditions warrant and are for informational purposes only. Information contained herein is not intended to be personal investment advice for any specific person for any particular purpose. We utilize information sources that we believe to be reliable but cannot guarantee the accuracy of those sources. Past performance is no guarantee of future performance; investing involves risk and may result in loss of capital. No graph, chart, formula or other device can, in and of itself, be used to determine which securities to buy or sell, or when to buy or sell such securities, or can assist persons in making those decisions. Consider seeking advice from a professional before implementing any investing strategy.

We are happy to provide a second opinion analysis of your portfolio