Market Commentary

August 2025

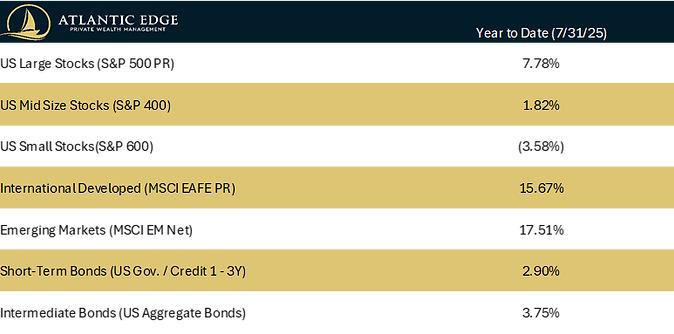

Year-to-Date Market Recap

Stocks

The first half of 2025 reminded investors that volatility can return quickly, even in otherwise strong markets. Geopolitical shocks, aggressive trade policies, and fears of recession drove sharp moves across asset classes. But just as quickly as uncertainty emerged, resolution followed. By quarter-end, markets had not only recovered but reached new all-time highs.

After two years of outperformance, US stocks trailed stocks in International Developed Economies (Europe, Japan, Australia, etc.) as well as stocks in Emerging Market economies (China, India, Brazil, etc.). Industrial, technology, utility and financial stocks have been the best performing sectors while consumer-related stocks along with healthcare stocks have lagged.

After a rocky start to the second quarter, the S&P 500 is back to record highs—powered by easing trade tensions, resilient corporate earnings, and a drop in geopolitical risk.

Bonds

At first glance, the bond market has appeared calm. However, underneath the surface, this year has been anything but quiet. A surge in yields and risk premiums in April triggered sharp volatility before bond markets ultimately stabilized.

Typically, events like “Liberation Day” (which increased geopolitical tension and recession risk) would push investors toward safer assets like Treasuries—driving yields down. Instead, yields rose sharply. As investors feared that:

-

Foreign holders of Treasuries might sell U.S. debt in response to new tariffs.

-

Slower growth from trade friction could expand the federal deficit.

-

Inflation might remain sticky, limiting the Fed’s ability to cut rates.

As headlines shifted toward progress on U.S.–China trade talks, bond yields and credit spreads reversed course and the average bond is up 3-4% on the year.

Stocks at All-Time Highs – Can this Continue?

Earnings revisions are often a useful gauge for predicting the stock market’s direction. These revisions reflect a company’s own updated forecasts, not analysts’ estimates, of future earnings.

-

When most firms raise their earnings guidance, stock prices tend to rise; when they lower guidance, stocks often fall.

-

Ahead of first-quarter 2025 earnings, many strategists expected firms to cut guidance due to tariff concerns. Instead, to the market’s surprise, many firms raised their outlooks despite the uncertain trade environment.

-

The percentage of firms with positive earnings revision is at its highest level in 4 years.

Bottom line: Despite uncertainty, firms have increased their expectations for higher earnings.

A Technological Revolution – the A.I. Race and Secular Bull Market Implications

Driven by the success of the “Magnificent 7” stocks (META, AMZN, MSFT, AAPL, GOOGL, NVDA, and TSLA), the concentration of the largest stocks in the S&P 500 is greater than at any time in its history. However, unlike peak concentration in 2021, the earnings concentration of these stocks has increased as well, meaning their earnings make up a larger part of the earnings of every firm in the stock market. This is largely due to massive spending and productivity gains centered around investment in A.I.

For example, Microsoft announced a 9,000-person headcount reduction. This typically happens in a period of slowing profit growth. However, as the CEO of Microsoft explained in his letter to employees, the ‘success we want to achieve will be defined by our ability to go through this difficult process of “unlearning” and “learning”. It requires us to meet changing customer needs, by continuing to maintain and scale our current business, while also creating new categories with new business models and a new production function.’

The CEO of Nvidia recently stated in a popular podcast that “A.I. is greatest technology equalizer of all time. Everybody’s job will be different and if you aren’t using A.I. you will lose your job to someone that uses A.I.”

It is certainly an exciting time but like all advancements in technologies before, there will be times too much hype will lead to overbought stock prices. Reconciling mania with realistic expectations is critical to navigating risks in the rapidly evolving environment.

We are optimistic that because of the broad-based application of this new technology, we expect stock market concentration to recede as companies across many different industries adapt and benefit from using A.I. in everyday operations, leading to higher profit margins and rewarding stock investors.

Will Tariffs Increase Inflation?

Since tariffs were announced on April 2nd, many raised concerns that once implemented, they would rapidly increase the inflation rate. Despite these fears, CPI decreased in the weeks following Liberation Day and evidence suggests that firms are passing through less of their cost increases to customers than predicted. It remains still too early to determine the impact on consumers for the following reasons:

-

Tariffs implemented in April only affected goods shipped after that date.

-

Expecting tariffs, many firms dramatically increased their inventory early in 2025, further delaying the price impact of tariffs.

-

If tariffs begin to impact inflation, we should begin to see its effect in late summer/early fall.

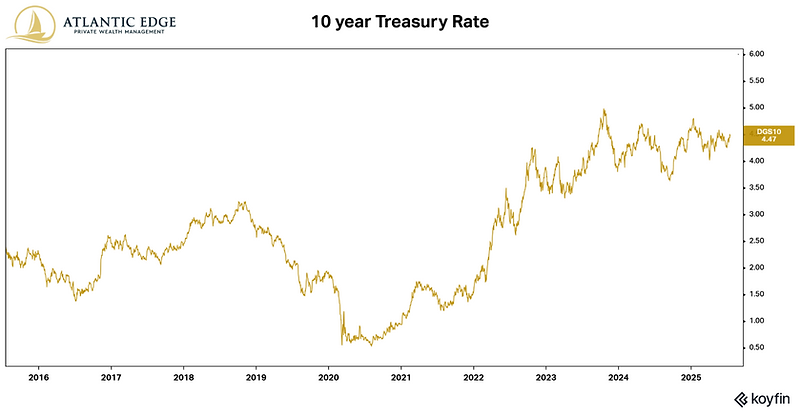

Sticking to the Short End on Bonds

Last quarter we detailed how investor’s profit from bonds in two ways; not only from the interest or “coupon,” but also price changes in the bond, which are tied to the interest rate. If the market interest rate decreases, the interest rate on the bond appears more attractive, causing the bond price to rise. Conversely if the market interest rate increases, bond prices fall.

-

The prices for longer maturity bonds are far more sensitive to interest rate changes than shorter maturity bonds. We experienced falling bond prices acutely in 2022 when higher inflation and Federal Funds Rate increases by the Fed caused a 3% increase in the 10-year rate.

-

While we saw interest rates rise in 2022 alongside the increases by the Fed, its far from certain we should expect the opposite if the Fed cuts rates before the end of the year. The 10-year treasury rate increased last year after the Fed lowered their rate by 1%.

-

Given this uncertainty and increased risk for longer maturity bonds, we believe it makes more sense to primarily invest in shorter term bonds, some of which offer yields over 5% with far less interest rate risk than longer term bonds.

Portfolio Positioning

Stocks

Short-term: Following strong earnings and higher guidance, we added exposure to larger growth-oriented stocks during the 2nd quarter while reducing exposure to medium sized companies as earnings grew faster for firms that were better positioned to negotiate tariff concessions for their products, like smartphones or semi-conductor chips.

Diversification has been a winning strategy so far this year and we expect this to continue to be the case. Sentiment indicators we rely on reflect a modestly overbought market and we would not be surprised to see a small pullback after a 25% gain from the April lows. However, despite seeing some slowdown economically, the economists at Ned Davis Research (our preferred research partner) are projecting a very low likelihood of recession on the horizon and a pullback in stocks is likely to be shallow and should be viewed as an opportunity to add to stocks with sidelined cash.

Long-term: There is massive investment going towards energy production, data centers, and technological improvements. All these are centered around the proliferation of Artificial Intelligence. Implementing this advanced technology in everyday operations will have lasting benefits for long-term stock investors.

Atlantic Edge Insights

Matthew Cochran, CFA

Robert Filosa, CFA

Ethan Caldarelli, CFA

Bonds

During the second quarter bond yields remained flat for the 10-year Treasury but fell for the 2-year Treasury. Unlike the 10-year Treasury, the 2 year is more sensitive to actions by the Fed and likely fell as futures markets began to predict a Fed rate cut as early as September. If the 2-year yield continues to fall while the ten year remains flat, we would expect shorter term bonds to outperform longer term bonds.

Early last quarter, as risks began to rise following the April 2 tariff announcement, we reduced exposure to lower quality bonds and increased exposure to shorter, higher quality bonds to protect portfolios from further downside risks. If economic growth continues to moderate throughout the second half of this year, a higher quality bond portfolio should provide ballast to equity markets while still earning an attractive interest rate.

Opinions expressed in this commentary may change as conditions warrant and are for informational purposes only. Information contained herein is not intended to be personal investment advice for any specific person for any particular purpose. We utilize information sources that we believe to be reliable but cannot guarantee the accuracy of those sources. Past performance is no guarantee of future performance; investing involves risk and may result in loss of capital. No graph, chart, formula or other device can, in and of itself, be used to determine which securities to buy or sell, or when to buy or sell such securities, or can assist persons in making those decisions. Consider seeking advice from a professional before implementing any investing strategy.

We are happy to provide a second opinion analysis of your portfolio