Atlantic Edge Insights

October 2024

Market Commentary

*Performance Year-to-date is through September 30, 2024

Stocks:

The stock market built on its first half returns with broad based gains over several asset classes (see graphic above) in the third quarter. After a very narrow second quarter, market breadth broadened substantially as CPI data came in below expectations, raising the probability that the Fed would begin cutting interest rates sooner than expected. After The Fed declined to cut rates at the end of July and investor concerns over a weak jobs report in early August, led the S&P 500 to drop 8%. However, subsequent economic data came in stronger than expected and a rally ensued during the second half of August. With all eyes on the Fed’s September meeting, they surprised many market participants by cutting rates by half a percent instead of a quarter. Stocks responded positively and rallied through the end of the quarter.

Last quarter we wrote that we expected the historical narrowness of the market to subside. That prediction materialized as the equal weighted S&P 500’s return nearly doubled the size weighted index as small and mid-sized companies both outperformed large companies. ‘Value’ style stocks also outperformed ‘growth’ style stocks. One surprising development was that utility stocks led all 11 sectors in the S&P 500 – a rare occurrence in a positive market environment, where utility stocks’ defensive characteristics often make them leaders in down markets.

International developed stocks outperformed US large companies in the 3rd quarter as markets began to price in Fed cuts. Stocks in Emerging Markets also outperformed US large company stocks as China rallied hard late in the quarter as the 2nd largest economy announced massive stimulus to help ease their slowing economy.

Bonds:

The 3rd quarter was very strong for bonds, particularly those with longer maturities. As the market narrowed in on the timing of the Fed’s cutting cycle, yields fell across the curve, which caused bond prices to rise and was the primary source of positive returns during the quarter. High yield bonds and their safer counterparts all performed well during the third quarter.

A Good Environment for Stocks:

Sticking the landing

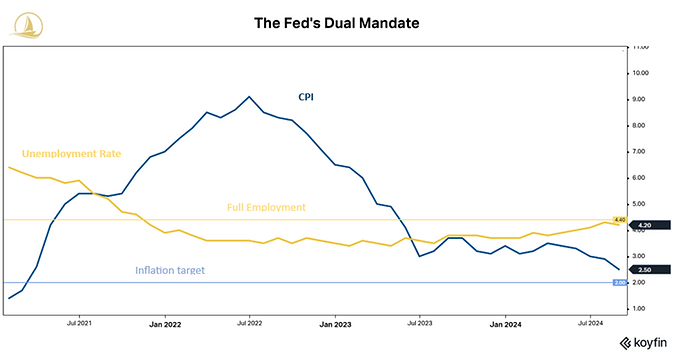

The Federal Reserve’s job has been difficult since the onset of the Pandemic. While low interest rates and excessive government stimulus propped up the nation as the economy shut down, it also led to 40-year high inflation. To control inflation, the Federal Reserve embarked on a historically fast hiking cycle, increasing the Federal Funds Rate from 0% to 5.5% in 16 months. In September, the Federal Reserve reduced the Federal funds rate by a half of a percentage point. Historically, when the Fed cut rates because prices are stable, stocks usually increased, but when they cut rates because of employment concerns, stocks usually fell. In the chart above, we can see that inflation has lowered considerably and approaches the 2% target, while unemployment has increased and approaches “full” employment line. While the future of unemployment remains less clear than the inflation outlook, the rise in unemployment in 2024 was driven more by new job seekers than by job losses. This distinction is important because job losses, rather than just an increase in the unemployment rate, tend to be a stronger predictor of recessions. Time will tell whether the Fed was able to “stick the landing”, but they seem to have done a good job so far.

“Don’t Fight the Fed” – Martin Zweig

The Federal Reserve has officially pivoted and is now accommodative, meaning they are no longer trying to restrict the economy with higher rates, like they have been since 2022. Last month we wrote that historically the stock market increases when the Fed begins cutting rates and a recession does not begin within the next 12 months. While we are confident that easing Fed policy will provide tailwinds for the stock market, these positive effects need to be considered in a broader context. “Don’t Fight the Fed” means more than simply adding to US stocks when the Fed is cutting rates. In 2023 and 2024 when interest rates were high, positive stock market returns were driven by few stocks. The prices of those stocks, relative to both historical averages and to the rest of the market, remain very high and benefit from the Fed’s higher rates because they earned more in interest on excess cash than they paid on older, low interest loans. Instead of these stocks leading the market higher, we expect positive returns to primarily come from the remaining stocks that were left behind. Not only are valuations far more attractive, but they also will benefit from reduced interest payments as The Fed lowers rates. Recognizing this dynamic and focusing investment on stocks previously left behind takes far better advantage of an easing Fed policy.

“Don’t Fight the Tape” – Martin Zweig

The tape is short for the ‘ticker tape’ that printed out stock prices transmitted over telegraph lines that were in use for close to 100 years starting in 1870. “Don’t fight the tape” simply means that if the stock market is exhibiting a strong trend, be cautious betting against it. Conversely, if the market is exhibiting a poor trend, it would behoove an investor to be cautious. As of late, the stock market is exhibiting a strong trend as several of our 50-day and 200-day indicators are positive (see below).

“Beware of the Crowd at Extremes” – Ned Davis

Don’t fight the Fed, don’t fight the tape, and beware of the crowd at extremes are fundamental rules of research when we determine overall investment strategy in the portfolios we manage. Despite the Fed being accommodative, and the tape being strong, the investing public is not overly optimistic. This could be for any number of reasons, not the least of which would be uncertainty related to a US Presidential Election and significant geopolitical challenges. We look at this as a slight positive as our favorite sentiment gauge is reflecting just ‘neutral’ (see orange line below). As a reminder, sentiment is a contrarian indicator, the market has performed worse when the investing public is overly optimistic and performed the best when sentiment is extremely negative.

The Risk – Expensive Large US Stocks

The environment for investing is good, but not great, because despite broader returns, valuations remain expensive among large cap stocks. Valuations are judged by comparing the stock price an investor pays for a company relative to how much per share profit the company generates (referred to as a P/E ratio). Assessing current valuations when viewed in the context of history helps us get a feel for how expensive the average stock is in the S&P 500 relative to other periods in history that preceded market declines. Right now, relative to a 35-year history, the S&P 500 is in the ‘overvalued’ zone and approaching the ‘very overvalued’ zone (orange line below).

When we have been in this overvalued zone in the past, it has been especially important to be selective when buying companies with relatively cheaper valuations and minimizing exposure to those companies that are the most expensive.

Economic Strength Evidence in Bond Markets

Bond markets often provide early signals for the economy through the premium paid for risky bonds over risk free bonds (Treasuries), known as the ‘credit spread’. When spreads are high, bond investors are demanding higher yield for risky bonds. These higher spreads are often driven by fear of a future economic downturn. Conversely, when spreads are low, bond investors accept lower yields when they perceive economic risks as low. Since recession fears subsided in late 2022, credit spreads between Treasuries and high yield bonds have been lower than their historical average, signaling a healthy economy.

Often, after the Fed begins reducing the Federal Funds Rate, which directly affects short term rates, longer term rates, like the ten-year Treasury rate, tend to fall as well. However, this relationship between easing cycles and falling longer term rates is due to correlation and not causation. The causal relationship between lower 10-year Treasury rates during an easing cycle is future recessions. When the Fed cuts rates to control high unemployment, recessions often follow. Since 1970, the ten-year rate has fallen during a Fed easing cycle in all but four cases; each time the economy did not fall into recession. In the eight remaining cases, seven were accompanied by a recession. If a soft landing is our most likely outcome, we do not expect longer term rates to fall during this easing cycle.

Portfolio Positioning

Stocks:

Short-term:

Market returns in the 3rd quarter broadened significantly as stocks began to price in larger anticipated cuts by the Federal Reserve (“Don’t fight the Fed”). The market trends have been strong due to better than expected underlying economic growth and easing monetary policy (“Don’t fight the Tape”). Larger growth-oriented stocks remain expensive relative to smaller stocks (“Beware of the Crowd at Extremes”), even after their recent underperformance. The trends driving outperformance of smaller stocks, accelerating earnings growth rate and easing monetary policy, are expected to continue.

Internationally, similar economic trends contributed to broad returns as the broader market outperformed the largest European stocks, known as “Granolas.” To take advantage of this broad market strength we increased equity exposure, resulting in an overweight to US stocks that focus on smaller more attractively valued companies.

Long-term: Over the next year when the Fed is expected to rapidly reduce rates, we favor a more equal weighting of stocks in your portfolio. Over longer periods we expect market concentration to recede substantially from all-time highs. As market concentration recedes, the largest companies should underperform an equally weighted average of all companies. To take advantage of this dynamic we’ve positioned portfolios to hold the largest stocks below their weight in the overall market.

Bonds:

The benchmark bond index increased over 3% during the quarter as interest rates fell across the yield curve. We do not expect longer term rates to fall now that the Fed easing cycle has begun and maintain exposure to interest rates slightly below our benchmark. As short-term rates come down, we also expect borrowing costs for riskier companies to fall as well, which should lower their debt servicing burden. While these companies earn a higher yield, they are also the most vulnerable to deteriorating economic conditions. If fundamentals begin to turn, we remain ready to reduce lower quality bonds in favor of higher quality bonds.

Atlantic Edge Insights

Matthew Cochran, CFA

Robert Filosa, CFA

Ethan Caldarelli, CFA

Opinions expressed in this commentary may change as conditions warrant and are for informational purposes only. Information contained herein is not intended to be personal investment advice for any specific person for any particular purpose. We utilize information sources that we believe to be reliable but cannot guarantee the accuracy of those sources. Past performance is no guarantee of future performance; investing involves risk and may result in loss of capital. No graph, chart, formula or other device can, in and of itself, be used to determine which securities to buy or sell, or when to buy or sell such securities, or can assist persons in making those decisions. Consider seeking advice from a professional before implementing any investing strategy.

We are happy to provide a second opinion analysis of your portfolio